A No Credit Check Loan is typically a type of loan in which a lender determines the “creditworthiness” of a potential borrower without conducting a hard credit How do No Credit Check Loans work? So how can you borrow money without a credit check? You might find yourself considering a no credit.Payday loans without checking account requirements. Check out our selected lenders and loan companies where you can take out loans even though you Get a free bank account with N26 in less than 10 minutes and have your loan with PersonalLoans.com transferred to your new bankaccount.No bank account required. No prepayment penalty. Bad credit OK. Without a checking or savings account, your loan options may come up short. But alternative services could be a way for you to bridge a financial gap without the need for your local bank.

Category: news

Nations trust bank housing loans

Nations Home Loan. For creating or remodeling your private space. Building a home for your family is bound to be an emotional process. Whether you are moving to a new place or simply redecorating, Nations Home Loans will give you peace of mind as you take the first steps towards creating your.

What is a bank customer’s share of the profits made on loans?

Banks are financial institutions that provide customers with a variety of valuable services, including the ability to wire money to a person or company, the ability to store money in a checking or savings account, the ability to collect interest on investments, the ability to receive loans, and much more.The customers’ are because the money is owed to someone else. Banks have to keep a certain percentage of their assets as reserves for borrowers Most retail banks have products for personal customers, such as . This means that all customers who have been granted a loan have the same.Banks take customer deposits in return for paying customers an annual interest payment. The bank then uses the majority of these deposits to lend to other customers for a variety of loans. The difference between the two interest rates is effectively the profit margin for banks.a sum of money borrowed from a bank. capital. the money invested in a business. stocks or shares. certificates representing part-ownership of a company. portfolio. all the investment owned by an individual or organization. returns. the profit made on investments. bankrupt. unable to pay debts or.A supply ___ is the way of a product form a manufacturer to a customer. A secretary makes sure the office has enough ___. A person who works with the most important clients is called Key ___ Manager.The cash received from the bank loan is referred to as the principal amount. The principal payment is recorded as a reduction of the liability Notes Payable or Loans Payable. Let’s also assume that the company makes a payment of $1,000 consisting of $60 for interest and $940 for principal, the.What are the key differences between the two? With debt, the bank giving the loan requires interest payment On the other hand, if the company is successful, equity investors benefit and make profits on the eventual sale of their equity stake. A return is the amount of profit made on an investment.Savings account interest is the bank customer’s share of th e.

Continue reading “What is a bank customer’s share of the profits made on loans?”

Westamerica bank car loans

Find reviews and ratings for Westamerica Bank. Learn more about this and other mortgage lenders at Bankrate.com.Westamerica Bancorporation operates as a bank holding company. It provides range of banking services to individual and corporate customers in Northern and Central California. The company provides loans and lines of credit, online services, mobile banking, checking, savings, credit cards.Business Loans and Lines of Credits. Our business bankers will work with you to customize a. Property Improvement and Equipment Loans Upgrade or expand your income-producing capability. Real Estate Loans Finance income-producing property or use funds for other business purposes.Westamerica Bancorporation is the holding company for Westamerica Bank and its subsidiaries. The commercial and regional community bank, headquartered in San Rafael, California, has $4.7 billion in assets and more than 90 branches in Northern and Central California.Westamerica Bancorporation operates as a bank holding company for Westamerica Bank that provides various banking products and services Its loan portfolio includes commercial, commercial and residential real estate, real estate construction, and consumer installment loans, as well as other.Call Loan Express at (800) 514-1460 and apply over the phone. Answer a few simple questions, and in most cases, you’ll know right Auto Loans For the purchase or refinance of a new or used car or light-duty truck. Extended repayment terms available. Personal Loans For a variety of needs, such as a.Westamerica Bank headquartered in 1108 Fifth Avenue, San Rafael, CA, 94901 has 82 branches, ranked #104 in U.S. Also check 20+ years of financial info, client reviews, and more here. Westamerica Bank 1108 Fifth Avenue San Rafael, CA 94901 Status: Active.Westamerica Bank is a regional community bank with over 80 branches and 2 trust offices in 21 Northern and Central California counties.Westamerica Bancorporation operates as a bank holding company for Westamerica Bank that provides various banking products and services to individual and commercial customers. The company accepts various deposit products, including retail savings and checking accounts.

Citizens bank student loans reddit

Through Student Loan Planner, you could get a significant student loan refinance bonus too. Citizens Bank is a good option for borrowers with strong credit looking to refinance $50k to $100k and who don’t mind opening a debit or credit card account with Citizens Bank.Why Get a Student Loan from Citizens One? The student loan marketplace has become crowded with the rise of multiple non-traditional lenders. But unlike many of the new players, Citizens One is the national lending division for Citizens Banks, N.A., a bank with a nearly 200-year history of serving.Citizens Bank, sometimes referred to as Citizens One depending on your state, offers a number of student loans. These options include undergraduate, graduate, and parent student loans for those planning on attending college. The company also offers two refinancing products, one for students.Citizens Bank. Here to help make you ready for whatever’s next on your journey. Follow us for life hacks, money tips, and stories that will inspire you.Citizens Bank student loans are serviced by Firstmark Services, a division of Nelnet. You can set up automatic payments and manage your account online, as well as receive interest rate discounts for automatic payments and loyalty if you have another financial account with Citizens Bank.Personal loans with Citizens Bank come with flexible repayment terms and competitive interest rates. Here’s what you need to know before you apply. Personal loans with Citizens Bank come with no application, origination or late fees. And you get an opportunity to get two interest rate discounts.

Central bank auto loans

Whether you’re looking for auto loan rates for a new or pre-owned car, we offer fixed and variable rate bank loans for both. Get a rate discount on a fixed rate auto loan with automatic payments from your First Commonwealth checking account, making it easier for you to manage your monthly budget.Sierra Central Credit Union provides vehicle loans for both new and used automobiles. Visit our website or one of our branch locations for more Membership and/or participation fees may apply. First time auto loan buyer must meet our minimum credit criteria and applicants with derogatory credit.Central Bank remains a community bank, dedicated to serving the people and businesses of Kentucky. Ready to take off into the new year. All Central Bank locations will be closed on Friday, January l. Check our website for locations open on Saturday, January 2 from 9a-1p.Consumer & Auto Loans. Apply Online. Our loan specialists will work closely with you to develop a financing plan to meet your needs for the purchase of new and used vehicles, recreational vehicles, boats, or other personal needs.

An increase in the amount of bank loans should shift the aggregate:

The outstanding amount is the Total due of your loan that you need to pay to the bank including interest and principal till date. Ledger outstanding is nothing but the amount which is appearing in the books of accounts ( now a days in computer ) on particular date say 2 lac on 14/2/2019.Because the government has influence over several of the components of aggregate demand, it has the power to shift AD through its policy choices. Why aggregate demand does not increase for the same reason in response to a decrease in the aggregate price level ? In other words, what causes.Shouldn’t a interest rate rise cause cost of production to increase, therefore shifting SRAS to left? Thanks in advance. $begingroup$ Aggregate demand shifts left because the rise in interest rates in an economic model should decrease demand. The issue is that the shift in the real world is.The aggregate supply curve shifts outward to the right. All right, and we find ourselves with less We have an example recently in Spain, of a deregulation which was the liberalization of the labor At the same time it shifted the aggregate supply curve out to the right. So it should leave us, and it is in.The shift will be equal to the increase in the amount multiplied by the spending multiplier. This multiplier is found by dividing (1 / marginal propensity to consume). The MPC is the value that shows how much of the new money injected into the economy will be spent by consumers and, thus, is the.A ) An increase in potential GDP increases aggregate supply and shifts the A S curve. leftward. To get ride of it, we should reduce the AS by increasing. wage rate( less workers will be hired, due amount of reserves banks are required by the Fed to be held as a percentage of the bank’s deposits.

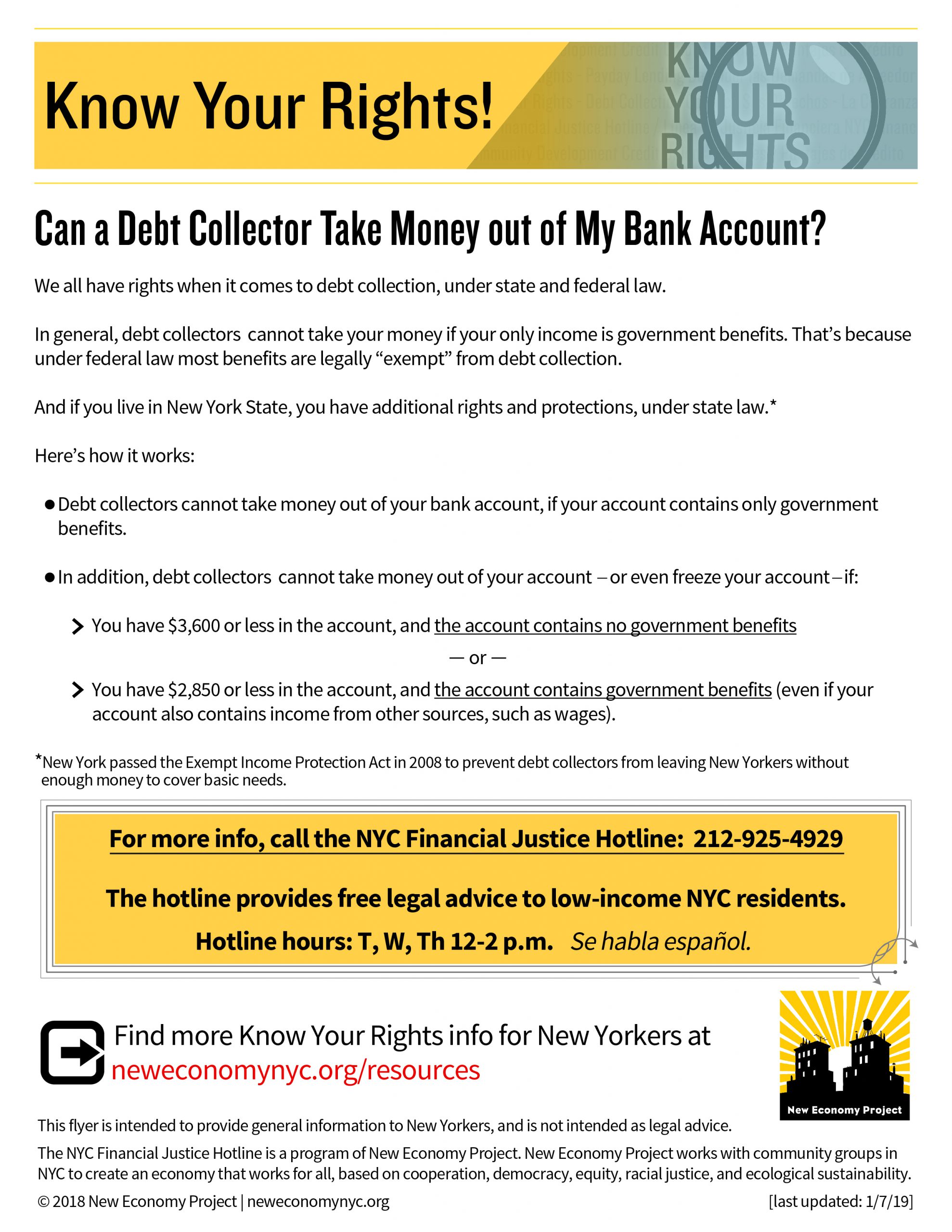

Loans without a bank

Most loans without a bank account are not well-known to potential borrowers, but once you have the facts, you’ll When it comes to loans without a bank account, a secured loan is a great option. A secured loan could open the door to hundreds or even thousands of dollars in immediate loan money.Citizens Bank offers private student loans without a cosigner to borrowers with good credit (more on that later). There are no application or origination Funding U offers an undergraduate student loan without a cosigner. As a smaller scale lender, you can borrow up to $10,000 per school year, up to a.Banks and credit unions are not required to cash checks for non-customers, but many banks will cash a check payable to a non-customer if the check is written The caller offers the customer a loan and requests payment to secure the loan. Of course, the loan is never received and the customer of the.Without a bank account, you have to use other payment options that cost money or delay your Benefits of Keeping Bank and Credit Card Accounts at the Same Bank. Where you have your bank It is also shifting swiftly towards profit-sharing loan facilitation model, which has reached 50% of total.Without a bank account you’re generally limited to short-term loans. Auto title and pawn loans typically require collateral, while other options don’t. You might still qualify for a bitcoin loan without a bank account by buying crypto through PayPal with a prepaid debit card. But it could take more time than.You might need to pay someone who doesn’t have a banking account. It might sound like a hassle, but here are eight simple and low-cost ways of to send money . Rates on 30-year fixed loans hit yet another all-time low this week.

No bank account loans near me

No Bank Account Loans lenders in the USA. Want to find more options? Sign up to compare more payday loans from our partners.Open a bank account from Citi checking and savings accounts and CDs, to banking IRAs. Apply for a personal loan, or learn how to invest in your financial future. Citi’s online banking services, credit cards, home & personal loans, and investments.

Apple bank personal loans

Choosing a personal loan lender that’s right for your individual needs can be difficult in a market with so many options. In order to find a lending institution you trust A SoFi personal loan is a great option for borrowers who make a decent income and have good credit. There are no origination fees, no late.Apple Bank for Savings is an FDIC insured bank located in New York and has 15600860 in assets. Customers can open an account at one of its Compared to other banks in New York, Apple Bank for Savings has a significantly higher percent of Multifamily Mortgages, Commercial and Industrial Loans.