Long-Term & Short-Term Financing from banks and credit unions – Financing is a very important part of every business. Firms often need financing to pay for their assets, equipment, and It is backed by the bank that issues it or by the corporation that promises to pay the face value on maturity. Firms with excellent credit ratings.

Types of Business Financing

Trade Credit is the type of business financing from other businesses (or suppliers). The terms are usually extended to 2/10, net 30 which means that the business gets a 2% discount if the debt is repaid within 10 days, otherwise, the terms are for 30 days.

Short-term Personal Loans are type of business loans for up to 1year. This means that they have to be repaid to the lender during that time. Short-term loans are more convenient for a small business that needs instant funds.

Business Line of Credit will provide the company with access to cash at the time when it’s most needed. It’s an unsecured cash loan with no collateral required. Interest rates are also rather low as well as favorable terms.

Factoring from the company’s accounts. It’s used to get cash for short-term needs. It’s a good option if a business can’t qualify for a short-term business loan or unsecured line of credit. The company will have to sell its uncollected invoices to a third party (or a factor) in order to get the money.

Merchant Cash Advance is a secured loan backed by a business’s credit card receipts. A steady flow of credit card receipts is required for the type of business financing. There’re higher interest rates and very short terms.

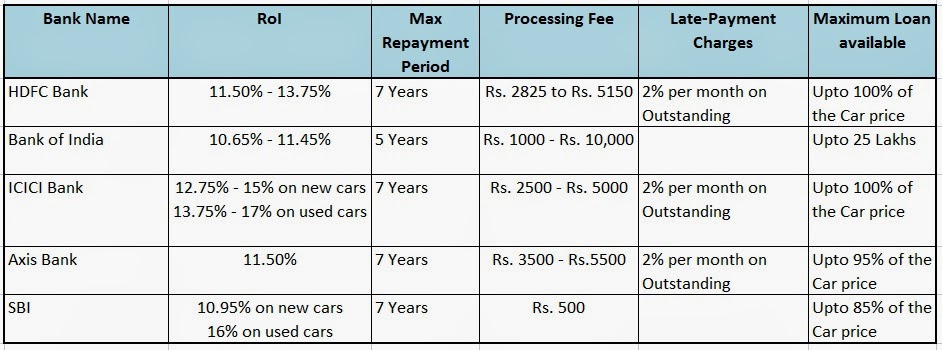

Bank Loans

Many businesses that need seasonal financing, apply for unsecured short-term bank loans which go in two types – lines of credit and revolving credit agreements. A line of credit offers financing for maximum one year. The cost is generally 10 – 20% of the loan. The revolving credit agreement charges an extra fee in addition to interest. And terms vary from 2 to 5 years.

What Are Short-Term Business Loans?

Small businesses prefer short-term financing instead of long-term loans that have higher interest rates and less convenient terms. Short-term business loans, especially trade credit, are also easier to get than an unsecured business line of credit.

Business loans with short repayment terms are provided for up to 1 year, mostly even less – 90 – 120 days.

Sometimes, the company has to provide collateral to obtain a business loan. Or they need to have good credit to get financing.

Why businesses may need Short-Term Financing

Business can use short-term loans are often used to buy seasonal inventory. A vivid example is a holiday business in need of money for the season.

Besides, a company may look for working capital to handle temporary difficulties such as paying payrolls, other expenses, your own bills, and other obligations.

How to Get Short-Term Business Financing

Short-term business loans certain documentation such as a record of your payment history for other loans, payment histories to your suppliers and your company’s cash flow history for 3 – 5 years, income statement. It all must be in a professional format.

Your credit score and credit history will also be checked by the lender who may require a certain minimum credit score level.

Depending on the qualifications, the company may qualify for a secured, unsecured, or signature loan or line of credit.