Investment banks do not take or keep the money of individuals. They help organizations and large companies raise money on the international financial market.

Development banks are financial organizations that help Third World Countries. They not only provide money for nations in Africa, Asia, and South America. The bank then uses the majority of these deposits to lend to other customers for a variety of loans. Many people could not make home payments during a weak economy. Banks provide funds for businesses as well as personal loans for any needs of individuals.

Banks play an important role in the economy by offering a service for people wishing to save.

- Regulate the banking industry

- Loan money to banks

- Give individual loans

- Give corporate loans

- Transfers any profits to the Treasury

How Bank Personal Loans help individuals and businesses

Bank Personal Loans play a significant role in the economy of a nation. It helps to raise the standards of people by providing loans to buy goods, houses, and automobiles and which ensures the flow of money in the market and hence the benefit of the economy.

Bank Loans

A bank loan is money borrowed from the bank and agreed to paid back to the bank. Bank loans suit a variety of planned and unplanned emergency expenses. All bank loans charge interest rates for a set repayment term. Bank loans can be used to start a new business or improve and expand an existing one. This, in turn, helps the nation’s economy to grow.

What banks offer Personal Loans?

Though most banks offer personal loans, it’s better to check in advance. Some of them provide personal loans only to current customers who receive preapproval. Other banks don’t offer personal loans at all.

If you apply for a personal loan with a bank, you may be required to indicate the reasons why you need the money. Typically, people borrow personal loans from a bank for debt consolidation, larger purchases like boats and RVs, or home improvement projects.

Why are Personal Loans from banks helpful?

Bank loans are helpful to the national economy for a number of reasons:

- Increasing purchasing power of the people

- Employment opportunities created

- Creation of wealth to the nation

- The standard of living of the loanees will increase

- GDP growth will be possible for granting loans

- Personal savings will improve

- Since the circulation of money increases further credit expansion possible

Related Questions

How do banks help expand and maintain the economy?

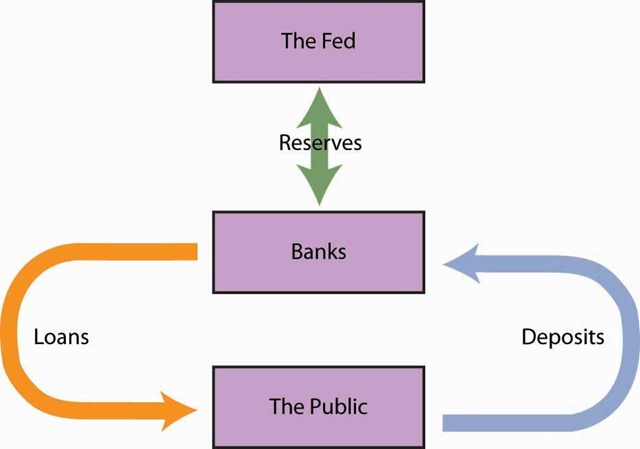

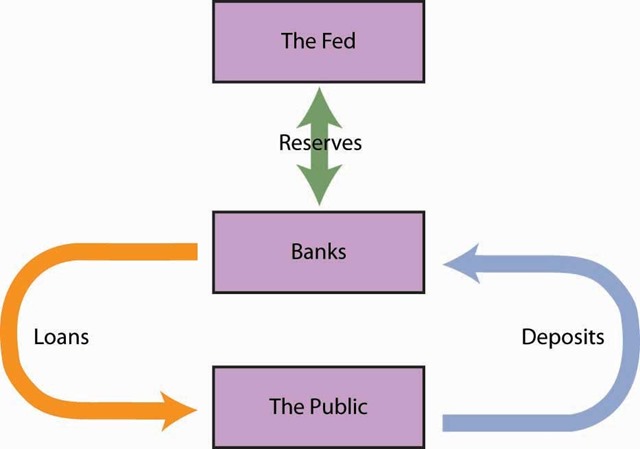

The main function of a bank is to play the role of a financial intermediary in the economy. They help keep the cash flow going in the economy by collecting deposits from people with surplus and granting loans with people who need extra money. The banking system plays an important role in the modern economic world. Thus, the banks play an important role in the creation of new capital (or capital formation) in a country and thus help the growth process. Bank loans facilitate commerce.

How to get a personal loan from a bank?

Bank loans usually have strict credit score requirements. It’s easier to qua;ify if you are an existing bank customer. Let’s check other tips that will help you get the loan from a bank:

Improve your credit.

Check your credit score for any mistakes.

Boost your income and pay down debt.

Increase your savings, if you can.

Where do banks get money to lend to borrowers?

Banks generally make money by borrowing money from depositors and compensating them with a certain interest rate. The banks make a profit by lending the money out to borrowers and charging them a higher interest rate.