According to the above portrayal, the lending capacity of a bank is limited by the magnitude of their customers’ deposits. In order to lend out more, a bank The reality is that banks first extend loans and then look for the required reserves later. Fractional reserve banking is effective, but can also fail.The Reserve Bank of India’s guidelines says that banks should give reasonable time to pay up and The borrower may be bankrupt or in no position to make further payments. He may get the option Recently, a bank offered a settlement offer to its NPAs in the education loan sector, in which up to.

Both the principal and the interest are included in the loan’s repayment. Most loans are secured loans, which require that borrowers put up collateral. to establish a monopoly position. penetration pricing.Loan requests are important to help people in financial difficulties. When writing a loan request to your bank or employer, it is essential to describe why you are borrowing the money and the plans you have. Additionally, mention the amount of money you need and how you intend to repay it. In such a letter.

If you are refinancing, the lender will usually require one months statements, to show enough for closing. Electronic statments are fine, make sure if the CHEVRON FINANCE FIRM is a branch of CHEVRON COMPANY that offer loans to individual and public sector that are in need of financial.Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is Unsecured personal loans are different from many other types of loans, like mortgages or auto loans, in that there is no collateral backing the loan.

PayPal has loans that don’t require a lot of paperwork, but Then, you’ll be able to upload documents to process the loan request faster, such as bank statements from your business checking account. to find the items mentioned in this video and support the channel at no cost to you! If you are like me.Loans were then made to merchants, shippers, and landowners at rates of interest as low as 6 percent per annum to as high as 48 percent a month for the riskiest ventures! Most of the early banks of any size were Greek in origin. The Romans generally tolerated banking practices, but were hesitant to.

In this way the bank makes its main profits. The primary function of a bank today is to act as an intermediary between depositors who wish to make interest on their savings, and borrowers who wish to obtain capital.When applying for a loan, it is good to do a thorough research in order for you not to underestimate or overestimate the amount of money you require. This is due to the fact that underestimating could lead to financial problems in the future. Overestimating on the other hand makes the bank question.

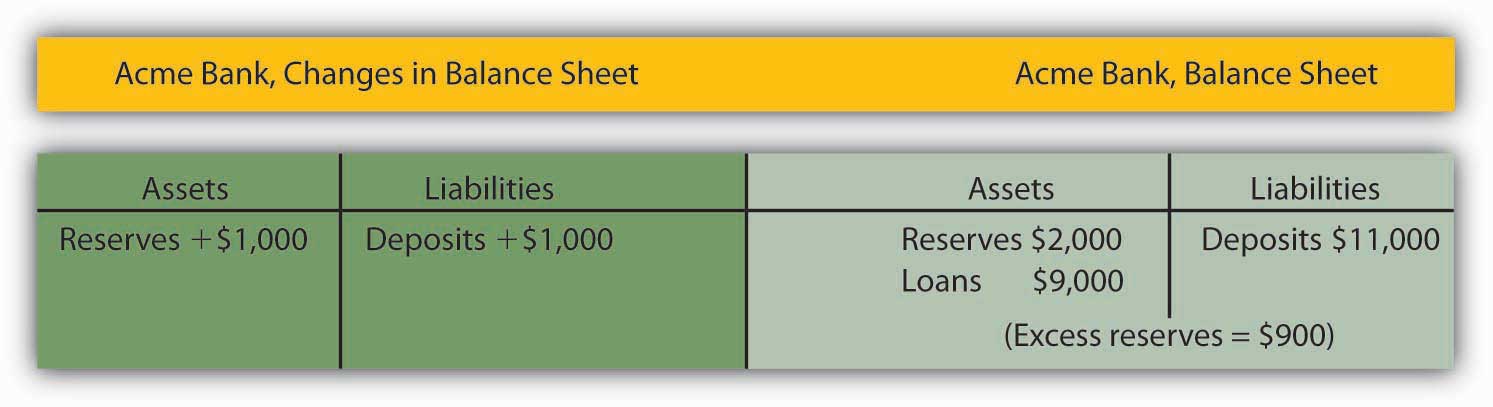

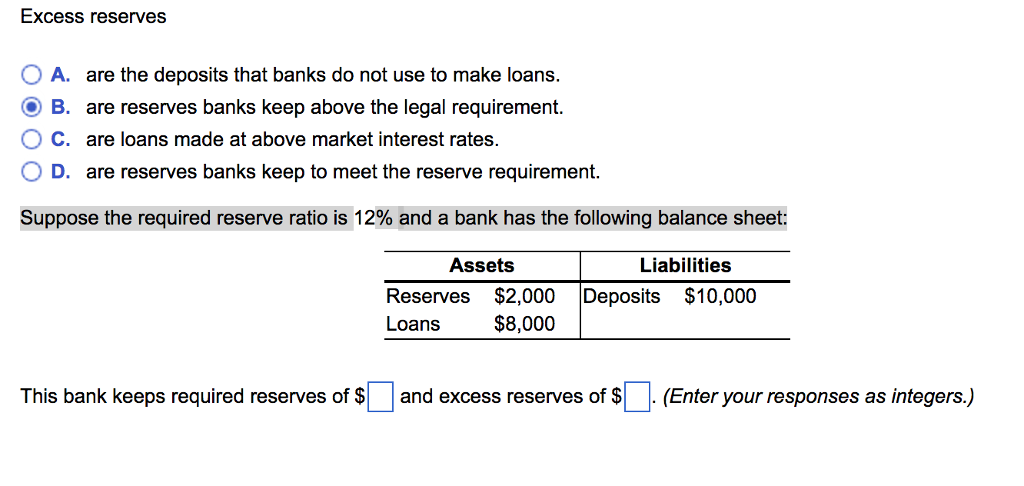

If the required reserve ratio is 10%, then this bank is violating its required reserve level by $20. 7. What is the difference between insolvency and illiquidity? Insolvency occurs when bank assets are less than its Compensating balances can act as collateral for loans made by banks to those firms.The bank makes money when people miss a payment, and they get to add on all of the accrued interest to the loan. The 0% is for a certain time They can also sell these loans to an investment bank or other entity, but they would be sold at a deep discount, so the difference will be made up in.

Getting a bank loan approved is not the easiest process. In light of recent economic troubles across the nation, lenders are looking for a lot more in a loan applicant and are more strict. While there are several key areas lenders will be focusing on, it is important that you are ready to present the perfect.When A Bank’s Excess Reserves Are Zero, It Can No Longer Make Loans. O A. False O B. True Click To Select Your Answer. 10/9/19. $0. O D. $5,000. When a bank’s excess reserves are zero, it can no longer make loans. O A. False O B. True Click to select your answer.