n23.ultipro.com is a website that provides users with access to a wide range of online services, including social media management, content marketing, and SEO. With such a diverse range of offerings, it’s no wonder n23.ultipro.com has become one of the leading online providers in its field. In this blog post, we will take a look at 10 of n23.ultipro.com’s top competitors and how they stack up against the site. From price to features to customer service, read on to learn everything you need to know about these competing websites.

N23.ultipro.com

N23.ultipro.com is a top competitor in the online marketing space. They offer a wide range of services, including website design, web development, and online marketing. Their team of experts is available to help you create a successful online presence for your business. N23.ultipro.com offers a variety of services to choose from, so you’re sure to find the right one for your needs.

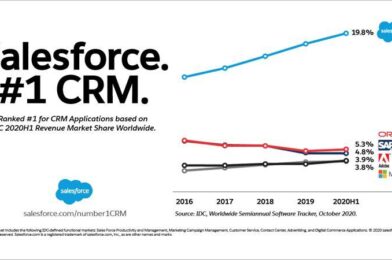

Salesforce

Salesforce is one of the most popular CRM software programs on the market. It’s used by small businesses and large enterprises alike. Salesforce offers a wide range of features, including marketing automation, customer relationship management (CRM), and lead management. It also has an app for both iOS and Android devices.

Some of Salesforce’s top competitors include Oracle, Microsoft Dynamics, SugarCRM, and Asana. Each has its own strengths and weaknesses, but all are widely used in the industry. If you’re looking for a comprehensive CRM system that can handle multiple tasks simultaneously, Salesforce is a good option to consider.

Also Read: Top 10 mol.gov.sa Competitors

Adobe

Adobe is a premier software company that creates tools for content creators and professionals everywhere. With products like Photoshop and Illustrator, Adobe provides the necessary tools to help people communicate ideas, create beautiful artwork, and edit documents.

The Adobe suite of products is very comprehensive and allows users to do many things that are not possible with other software options. For example, Adobe Photoshop can be used to edit photos, create logos, and more. Additionally, Illustrator can be used to create vector illustrations or logos.

Overall, the Adobe suite of products is a great option for anyone looking for quality tools that will help them work efficiently.

Oracle

1. Oracle is a world-leading software company that develops and delivers innovative database technologies. Oracle offers customers a broad range of products and services to meet their unique needs.

2. Oracle Database is the world’s most popular commercial database. Customers rely on its performance, scalability, availability, and security to power their businesses. Oracle Database is available in both cloud and on-premises versions.

3. Oracle also provides a broad range of software development tools such as PL/SQL, Java SE, and SparkSQL to help developers build applications with superb functionality and reliability

Aso Read: Allyoulike.com Competitors & Alternative Sites

Microsoft

Microsoft Corporation is a multinational technology company with headquarter in Redmond, Washington. Microsoft was founded in 1975 by Bill Gates and Paul Allen. It has a market capitalization of $2 trillion as of September 30, 2018. Microsoft provides Windows operating systems, office software, Internet Explorer and Edge browser, Skype, Outlook.com, Xbox Live gaming service, and more.

It has been criticized for its anti-competitive behavior and lack of openness to new ideas. In March 2019 the European Union announced that it would fine Microsoft €2.5 billion for violating antitrust laws since 2009. In July 2019 the U.S. Department of Justice filed a civil antitrust lawsuit against Microsoft alleging that it abused its dominant position in the computer operating system market through anticompetitive practices such as tying its Windows operating system to its own hardware products and preventing other companies from producing similar products

Google

1. Google is the biggest search engine in the world and it dominates the online search market. There are many other search engines, but Google is the most popular and used one.

2. It was founded by Larry Page and Sergey Brin in 1997. Since then, it has become one of the world’s most powerful companies.

3. The company has a complex business model with revenues generated from advertising, search engine fees, and sales of its products such as Android phones and Chromebooks.

4. Google also owns YouTube, which is one of the world’s most popular video sharing platforms with more than two billion active users each month.

LinkedIn

LinkedIn is one of the most popular social networking sites with over 600 million users. It offers a platform for business professionals to connect, share information, and build networks. LinkedIn has several features that can help businesses compete with n.ultipro.com.

One feature of LinkedIn is its “Company Pages.” These pages allow businesses to display their logo, company name, and contact information in a way that is both professional and attractive. They also provide a space for companies to share news and updates, as well as create job postings.

Another advantage of LinkedIn is its “Messaging” feature. This allows businesses to send messages to their contacts privately or publicly. Messages can be filtered by type (job notification, product announcement, etc.), subject matter, company size, location, or connection status (in/out). This feature makes it easy for businesses to target specific contacts and message them in the most appropriate way.

Finally, LinkedIn offers a “Lead Generation” feature that can help businesses generate leads from their contacts. With this tool, businesses can enter the contact’s name and email address and receive a list of potential customers who are likely interested in what they do. This allows businesses to reach out to these potential customers directly without having to spend time finding them on other websites or forums.

Also Read: Allyoulike.com Competitors & Alternative Sites

Twitter is a social networking and microblogging platform where users post and respond to messages using short 140-character bursts. The service can be accessed via desktop and mobile devices, and has more than 300 million active users. In order to remain competitive, n.ultipro.com must continue to improve its Twitter presence. Here are five ways the website can improve its Twitter strategy:

1) Use Twitter as a marketing tool: n.ultipro.com should use Twitter to promote its products and services to its audience of users. This can be done by posting relevant information about the company, including new product announcements, updates on current projects, or contests that offer prizes to participants. Additionally, the website should regularly interact with its followers on various topics in order to build relationships and foster trust.

2) Use hashtags: Hashtags are a great way for n.ultipro.com to reach a wider audience on Twitter through search engine optimization (SEO). By using specific hashtags related to the company’s industry or niche, n.ultipro.com can increase the visibility of its tweets in search results and attract new followers interested in what the company is talking about.

3) Share interesting content: When tweeting about specific products or services, n.ultipro.com should share content that is both valuable and engaging for its followers. This way, they will not only be kept up-to-date on important announcements but also persuaded

Slack

Slack is a messaging app for work that has quickly become one of the most popular tools for teams. It’s free, lightweight, and easy to use, and it has a growing number of integrations with other products. Here are some of the key competitors to Slack:

Google Drive: Google Drive is another popular messaging app for work. It’s free, has a wide range of integrations, and is used by many big companies.

HipChat: HipChat is a well-known messaging app for businesses. It can be expensive to get started, but it offers more features than Slack and is used by more companies.